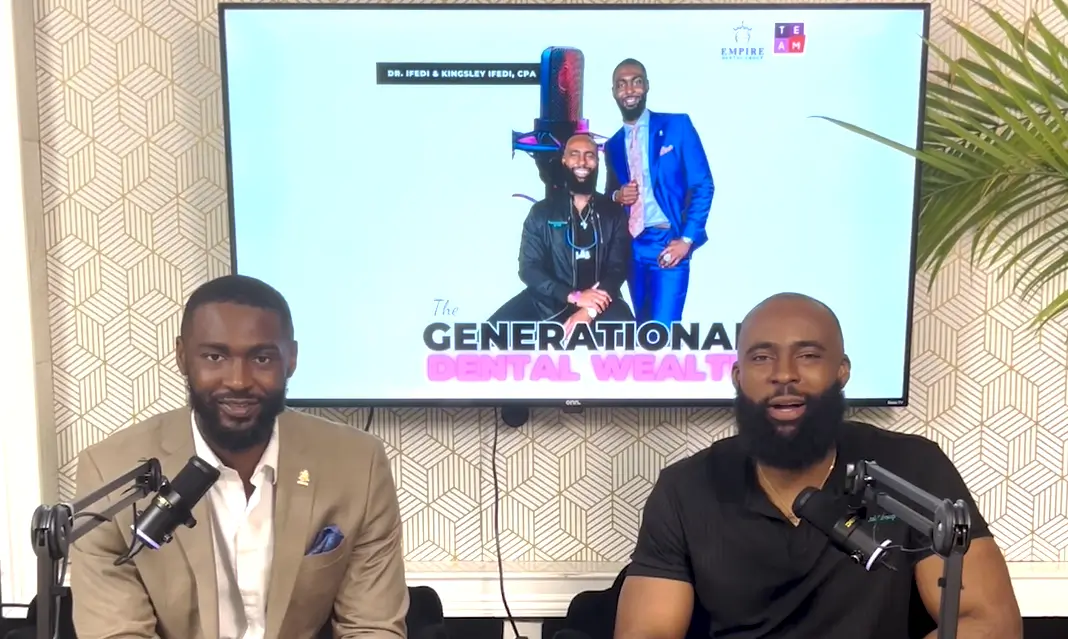

GENERATIONAL DENTAL WEALTH PODCAST S1 | EP. 7 | BLOG POST

Unlocking the Potential: Is Your Degree a Cash Machine or a Generational Asset?

Welcome to the Generational Dental Wealth Podcast! In this episode, we dive into a pivotal topic that’s relevant for dental school students, recent graduates, and those navigating transitional phases in their careers. Dr. Jamine Ifedi and Kingsley Ifedi,CPA, bring an engaging conversation to the table, exploring the multifaceted nature of utilizing a dental degree.

The discussion centers on viewing a dental degree not just as a means of generating income but also as a potential avenue for creating generational assets and leaving a lasting impact. They dissect the two concepts: a “cash machine” versus a “generational asset” to help individuals identify how they leverage their degree.

Unpacking the Cash Machine vs. Generational Asset Dynamic

Defining Compensation: They begin by outlining various forms of compensation beyond the direct financial aspect. Compensation extends beyond the monetary value, encompassing the environment, fulfillment, and the ability to accumulate assets through the profession.

The Cash Machine: Describing the cash machine, they delve into how it involves the exchange of energy for direct compensation. But it isn’t just about earning money; it can still provide a sense of fulfillment through the work.

Generational Asset: Contrasted with the cash machine, a generational asset involves a broader perspective. It incorporates not only earning income and finding fulfillment but also leaving a legacy. It’s about planting seeds of knowledge, passion, and advocacy that extend beyond the immediate context.

Embracing the Holistic Approach

At its core, building generational assets requires a holistic perspective that extends beyond monetary gains. It starts with instilling strong values within the family fabric – values like integrity, resilience, and empathy that form the moral compass guiding future generations.

Education serves as the cornerstone of empowerment. By investing in the intellectual capital of our descendants, we equip them with the tools and knowledge to thrive in an ever-changing world.

Preserving cultural heritage and traditions enriches the tapestry of generational wealth. By honoring our roots, we ensure that our legacy remains grounded in identity and belonging.

Extending the Conversation to Financial Planning

While values and traditions lay the foundation, sound financial planning provides the practical framework for building and preserving generational assets. It requires a long-term vision that transcends immediate gains and focuses on sustainable growth across generations.

Diversification is key to weathering market fluctuations and safeguarding wealth for the long haul. By spreading investments across different asset classes, we minimize risk and maximize resilience.

Estate planning ensures a smooth transition of assets from one generation to the next. Through tools like trusts and wills, we mitigate tax implications and facilitate the seamless transfer of wealth.

Financial literacy empowers future generations to steward their inheritance wisely. By imparting knowledge and skills in managing wealth, we cultivate a culture of responsibility and stewardship.

Conclusion: Synergy and Life Enrichment

In conclusion, the #1 secret to building generational assets lies in the synergy between holistic values and strategic financial planning. It’s a journey that marries the intangible with the tangible, the spiritual with the practical, to create a legacy that transcends mere material wealth.

As we navigate this journey, let us remember that true wealth is measured not only by what we accumulate but by the lives we enrich and the values we impart. It’s a legacy of resilience, wisdom, and prosperity that endures across generations, shaping a brighter future for all who inherit it.

To learn more, watch or listen to the episode by clicking the buttons below:

TEAM Financials provides tailored accounting solutions designed specifically for dentists, ensuring financial clarity and peace of mind.

Book a consultation today to streamline your practice’s finances and maximize profitability.